- Home

- Best Day Trading Brokers

Best Day Trading Platforms and Brokers in 2024

Written By

James Barra

Edited By

William Berg

Fact Checked By

Jemma Grist

The Best brokers for day trading provide low fees, robust charting platforms, quick execution, global market access, leverage options, and affordable minimum deposits. Every brokerage featured in this guide meets these high standards and is recognized for reliability.

Top 10 Platforms For Day Trading

We have reviewed 267 brokers as of 2024 and found that these are the 10 best platforms for day trading in Bangladesh. Every day trading broker was evaluated using real money or a test account.

FOREXWORDFX

FOREXMART

- Exness – Exness is a Cyprus-based forex and CFD brokerage established in 2008. With over 800,000 clients, several awards and reputable licensing, the broker has maintained its position as a highly respected global brand. Active day traders can access the popular MT4 and MT5 platforms, raw spreads and multiple account types.

- AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Deriv.com – Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs, multipliers and more recently accumulators, alongside proprietary synthetic products which can’t be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

- Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- IC Trading – IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- XM – XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

- Eightcap – Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- RoboForex – RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- eToro – eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

Best Day Trading Platforms and Brokers in 2024 Comparison

“DERIV remains an accessible broker for all experience levels, though experienced day traders will particularly appreciate the ultra-low commission rates, fast withdrawals and high-quality charting software.”

Admin Reviewer

Fees

When day trading, selecting a broker with low fees is essential, as the high volume of trades can quickly add up in costs and significantly impact your overall profitability

Our recommended platforms maintain low day trading fees, which we assess annually by tracking and comparing both trading and non-trading costs across brokers.

JUSTMARKET – Fees

Platforms

ADMIN

Author

Markets

Comparing Forex Brokers

Currency Pairs

Experienced traders may favor platforms offering a broader range of FX pairs, especially exotic pairs like EUR/MXN and GBP/ZAR. These pairs tend to have high volatility, presenting skilled day traders with opportunities to capitalize on price fluctuations.

Our analysis reveals that all of our top forex brokers offer more than 50 currency pairs, with CMC Markets leading the way by offering over 330 pairs. This includes a particularly comprehensive selection of exotic pairs and forex indices.

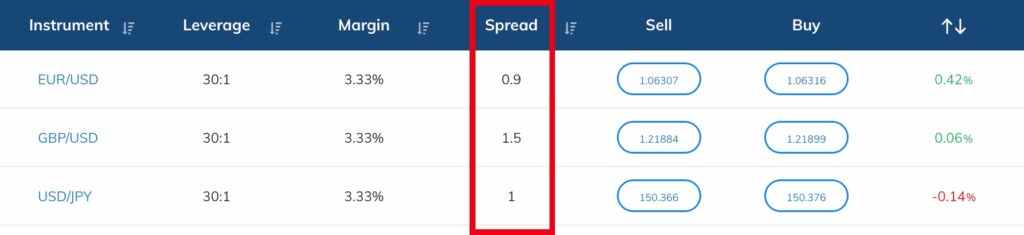

Pricing

We selected low-cost forex trading platforms to help maximize returns, as even minor fee differences can accumulate significantly over numerous day trades.

We assessed both the minimum and average spreads on key currency pairs, including EUR/USD, GBP/USD, and EUR/GBP, by recording spreads during the most active trading sessions—the US/London overlap and the Sydney/Tokyo overlap. These spreads were then compared to industry averages for accuracy.