- Home

- Best Forex Brokers

Best Day Trading Platforms and Brokers in 2024

Written By

James Barra

Edited By

William Berg

Fact Checked By

Jemma Grist

- Excellent selection of currency pairs

- Great pricing on short-term trades

- Intuitive Forex charting platforms

- High levels of regulation and trust

- Fast and reliable order executions

Best Forex Trading Platforms And Brokers In 2024

- 1. JUSTMARKET: 90+ currency pairs. Fast execution of 30ms. 0.1-pip spreads on EUR/USD.

- 2. HEADWAY: Superb forex trading app. AI-driven market insights. Neat learning via Eightcap Labs.

- 3. ROBOFOREX: 330+ forex pairs and indices. No rejections or partial fills. Award-winning platform.

- 4. FBS: Low fees for day traders. Reliable execution and no requotes. Up to 1:500 leverage.

- 5. DERIV.COM: User-friendly forex platform. Great pricing for active traders. Highly trusted broker.

Comparison of Top Forex Brokers

1. EXCLUSIVE MARKET

Why We Chose It

Exclusive Market Broker offers a reliable, user-friendly platform with a wide range of trading instruments, including forex, stocks, and cryptocurrencies. Known for tight spreads, low fees, and strong customer support, it’s suitable for both new and experienced traders. The broker stands out with its robust educational resources, ensuring clients can make informed trades. Regulated by reputable authorities, Exclusive Market Broker provides a secure trading environment.

Pros

- User-friendly and feature-rich trading platform

- Wide variety of trading instruments

- Strong focus on education and market research

- Low fees and tight spreads

Cons

- Limited availability for weekend support

- Some restrictions on account types for smaller deposits

Exclusive Market Broker offers a reliable, user-friendly platform with a wide range of trading instruments, including forex, stocks, and cryptocurrencies. Known for tight spreads, low fees, and strong customer support, it’s suitable for both new and experienced traders. The broker stands out with its robust educational resources, ensuring clients can make informed trades. Regulated by reputable authorities, Exclusive Market Broker provides a secure trading environment.

2. JUSTMARKET

Why We Chose It

Just Market is suitable for beginners and intermediate traders who prioritize ease of use and basic functionality. While it offers competitive pricing and good educational resources, traders seeking advanced features or a wider range of instruments might want to consider alternatives.

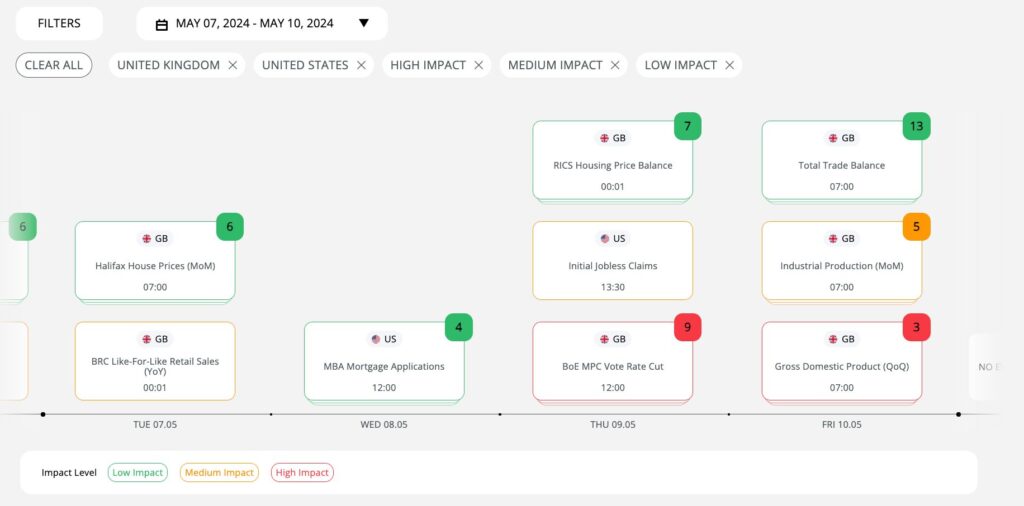

The platform’s relative newness means some features are still in development, but the strong customer support and security measures make it a viable option for many traders.Year after year Eightcap delivers for forex day traders, earning it a ‘Runner Up’ position in our selection of the best forex brokers in 2024. Despite offering a smaller selection of FX pairs than Pepperstone, at around 50, it stands out with its best-in-class tools, notably the AI-powered economic calendar.

Pros

- The Basic package offers commission-free trading and an intuitive platform suitable for beginners, though it comes with higher spreads and limited technical analysis tools

- Offers risk-free practice with virtual $100,000 and full platform access, although it's limited to 30 days and doesn't fully reflect real market conditions.

- Regulated by standard financial authorities with two-factor authentication and 24/5 customer support, though response times can vary during peak trading hours

- The platform provides user-friendly interface and mobile trading capabilities, however it lacks social trading features and advanced customization options found in more established brokers

Cons

- Despite offering 24/5 support, the service is marked by longer response times during peak hours, limited weekend support, and restricted direct phone access for lower-tier accounts.

3. ROBO FOREX

Why We Chose It

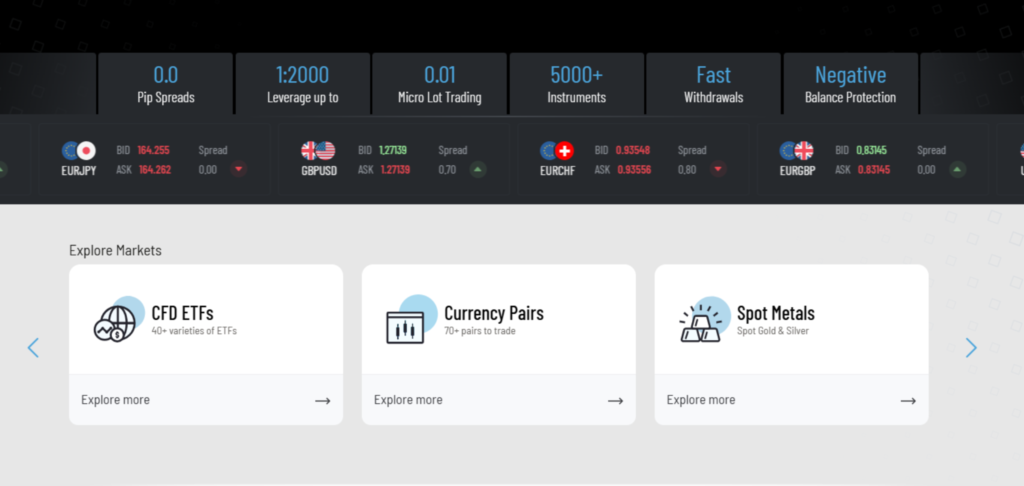

I’ll provide you with key information about RoboForex broker while noting that this information is based on knowledge as of early 2024.

RoboForex is a multi-asset broker founded in 2009, offering trading services in forex, stocks, cryptocurrencies, indices, and commodities.

Key Features:

- Regulation: Regulated by FSC (Financial Services Commission) of Belize

- Minimum Deposit: Starting from $10 (varies by account type)

- Trading Platforms: MetaTrader 4, MetaTrader 5, R WebTrader, cTrader

- Leverage: Up to 1:2000 (varies by account type and instrument)

Pros

- Low minimum deposit requirements

- Multiple trading platforms available

- Wide range of trading instruments

- Copy trading features available

Cons

- Offshore regulation (Belize) may provide less investor protection than major financial centers

- High leverage options can increase risk of losses

- Some account types have higher spreads

RoboForex offers a comprehensive range of trading instruments across multiple asset classes, including over 50 currency pairs spanning major pairs (EUR/USD, GBP/USD, USD/JPY), minor pairs (EUR/GBP, EUR/JPY), and exotic pairs (USD/SGD, EUR/NOK); precious metals trading with Gold (XAU/USD), Silver (XAG/USD), Platinum, and Palladium; popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin; stock CFDs from major global markets including US companies like Apple and Tesla; major global indices such as US30, SP500, and DAX; and various commodities including Crude Oil (WTI and Brent), Natural Gas, and agricultural products like Coffee and Cotton, though availability may vary based on your account type and location, with different trading conditions applying to each instrument category.

4. FOREXMART

Why We Chose It

ForexMart is a retail forex broker established in 2015, operating under the regulation of IFSC (International Financial Services Commission) of Belize.

Key Features:

- Minimum Deposit: $1 (varies by account type)

- Trading Platform: MetaTrader 4

- Leverage: Up to 1:1000

- Spreads: Starting from 1.1 pips (varies by account type

Pros

- Very low minimum deposit requirement

- Multiple deposit and withdrawal methods

- Spreads: Starting from 1.1 pips (varies by account type)

- Leverage: Up to 1:1000

Cons

- Offshore regulation may provide less protection

- Limited range of trading instruments

DERIV.COM

Why We Chose It

Deriv is an established online trading broker founded in 1999, with over two decades of experience in the financial markets. Originally known as Binary.com, the company rebranded to Deriv in 2019.

Key Features:

- Multiple Regulators: Licensed by MFSA, LFSA, FSC, CYSEC, and others

- Minimum Deposit: Starting from $5

- Platforms: Deriv MT5, DTrader, DBot, SmartTrader, Binary Bot

- Leverage: Up to 1:1000 (varies by account type)

- Demo Account: Available with virtual $10,000

Pros

- Long-standing reputation in the industry

- Multiple trading platforms and tools

- Low minimum deposit requirement

- Extensive range of trading instruments

- Advanced algorithmic trading capabilities

- Strong educational resources

Cons

- Complex platform structure might confuse beginners

- Customer support can be slow during peak hours

- Not available in some major countries (US, Japan)

Comparing Forex Brokers

Currency Pairs

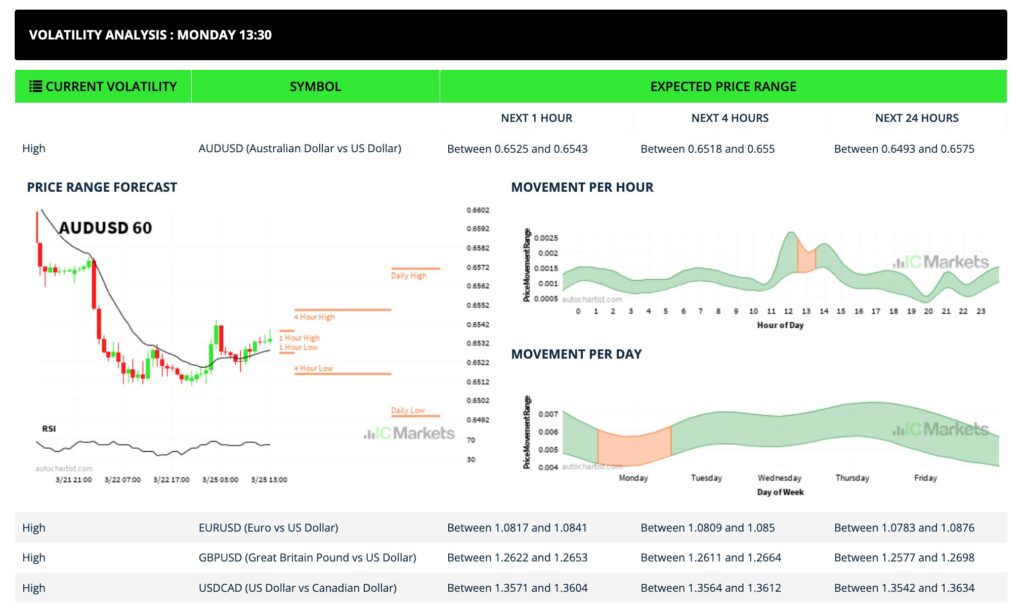

Experienced traders, in particular, may prefer a platform with a larger selection of FX pairs, notably exotics like the EUR/MXN and GBP/ZAR, which exhibit high levels of volatility that can be capitalized on by skilled day traders.

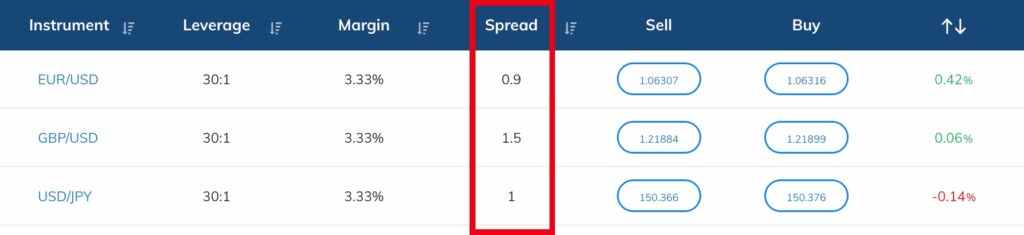

Pricing

We identified forex trading platforms with minimal fee structures designed to enhance profitability, as frequent traders can significantly benefit from reduced costs across multiple daily transactions. Our selection prioritizes brokers offering competitive spreads, low or zero commissions, minimal swap rates, and transparent fee structures that positively impact the bottom line, especially for day traders who execute numerous positions. We focused on platforms that eliminate hidden charges while maintaining quality execution, reliable technology, and necessary trading tools, understanding that saving even a few pips per trade can translate into substantial cost benefits when compounded across an active trading portfolio.